How much is home insurance? As this crucial question looms, delve into a comprehensive guide that uncovers the intricacies of home insurance costs, types of coverage, and savvy ways to save. Let’s navigate through the maze of factors affecting premiums, types of coverage available, and practical strategies to secure the best policy for your home.

Factors Affecting Home Insurance Costs

?w=700)

When it comes to determining home insurance costs, several key factors come into play. These factors can vary depending on the insurance provider, but there are some common elements that most companies consider when pricing home insurance policies.

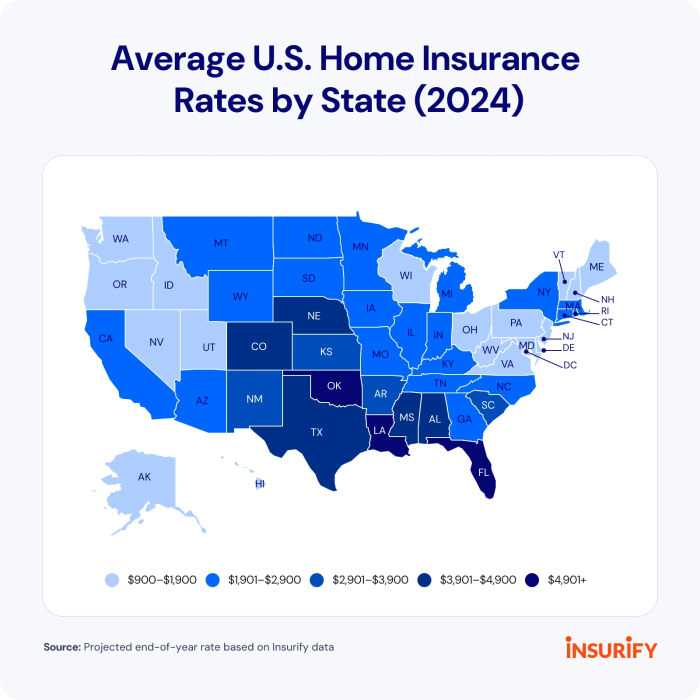

Location Impact on Home Insurance Rates

The location of a home plays a significant role in determining insurance rates. Homes located in areas prone to natural disasters, such as hurricanes, earthquakes, or wildfires, are likely to have higher insurance premiums. Additionally, the crime rate in the area can also impact insurance costs.

Home Value and Insurance Premiums

The value of a home is another crucial factor that influences insurance premiums. Generally, the higher the value of the home, the more expensive it will be to insure. This is because more valuable homes typically have more expensive repairs or replacements in case of damage.

Age and Condition of the Home

The age and condition of a home can also affect insurance costs. Older homes may be more prone to issues like plumbing or electrical problems, which can lead to higher premiums. Similarly, homes in poor condition or in need of repairs may be considered higher risk by insurance companies.

Other Factors Considered by Insurance Companies

In addition to location, home value, age, and condition, insurance companies also take into account factors such as the construction materials used in the home, the presence of safety features like smoke detectors and security systems, and the homeowner’s claims history. These factors help insurers assess the level of risk associated with insuring a particular home.

Types of Home Insurance Coverage

When it comes to home insurance, there are different types of coverage options available to protect your property and assets. Understanding the various types of coverage can help you make informed decisions about the level of protection you need for your home.

Dwelling Coverage vs. Personal Property Coverage

Dwelling coverage typically protects the structure of your home, including the walls, roof, foundation, and other attached structures, in the event of covered perils like fire, windstorm, or vandalism. On the other hand, personal property coverage helps to replace or repair your personal belongings, such as furniture, clothing, and electronics, if they are damaged or stolen.

Liability Coverage

Liability coverage is essential in a home insurance policy as it provides protection in case someone is injured on your property or if you accidentally damage someone else’s property. This coverage can help cover legal fees, medical expenses, and settlement costs in the event of a liability claim.

Additional Living Expenses Coverage

Additional living expenses coverage, also known as loss of use coverage, comes into play when your home becomes uninhabitable due to a covered peril. This coverage helps pay for temporary living expenses, such as hotel bills, meals, and other costs, while your home is being repaired or rebuilt.

Basic vs. Comprehensive Home Insurance Coverage

Basic home insurance coverage typically includes dwelling coverage, personal property coverage, liability coverage, and possibly additional living expenses coverage. It provides essential protection for your home and belongings. On the other hand, comprehensive home insurance coverage offers broader protection and may include additional coverage options, such as identity theft protection, water backup coverage, and more comprehensive liability limits.

Ways to Save on Home Insurance Premiums

When it comes to home insurance, there are several strategies homeowners can implement to reduce their insurance expenses and save on premiums. By understanding the factors that influence insurance costs and taking proactive steps, homeowners can potentially lower their overall expenses.

Bundling Home and Auto Insurance

One effective way to save on home insurance premiums is by bundling your home and auto insurance policies with the same provider. Many insurance companies offer discounts for customers who have multiple policies with them, making it a cost-effective option for homeowners. By consolidating your insurance needs with one provider, you may be able to enjoy significant savings on both policies.

Increasing Home Security

Another way to lower your home insurance costs is by improving the security features of your property. Installing a security system, smoke detectors, deadbolts, and other safety measures can reduce the risk of theft, vandalism, or other incidents, leading to potential discounts on your premiums. By demonstrating to your insurance provider that your home is secure, you may qualify for lower rates.

Impact of a Higher Deductible

Consider opting for a higher deductible on your home insurance policy to reduce your premiums. While a higher deductible means you’ll have to pay more out of pocket in the event of a claim, it can significantly lower your monthly or annual insurance costs. Evaluate your financial situation and risk tolerance to determine the right deductible amount that can help you save on premiums without compromising your financial security.

Other Strategies to Decrease Insurance Expenses

In addition to bundling policies, improving home security, and adjusting deductibles, there are other ways homeowners can lower their insurance expenses. Some additional strategies include maintaining a good credit score, staying claims-free, updating your home’s infrastructure, and comparing quotes from different insurance providers. By being proactive and exploring different options, homeowners can find ways to save on home insurance premiums while still maintaining adequate coverage for their property.

Home Insurance Quotes and Comparisons: How Much Is Home Insurance?

When looking for the best home insurance policy, obtaining multiple quotes and comparing them is crucial to ensure you get the right coverage at the best price. Here is a detailed guide on how to navigate the process of obtaining home insurance quotes and making effective comparisons.

Obtaining Multiple Home Insurance Quotes

- Start by researching and identifying reputable insurance companies in your area.

- Visit the websites of these companies or contact them directly to request quotes based on your specific needs and property details.

- Consider using online comparison tools to gather quotes from multiple insurers simultaneously for convenience.

Comparing Policies Based on Coverage Limits and Exclusions

- Review each quote carefully to understand the coverage limits for different policy components such as dwelling coverage, personal property, liability, and additional living expenses.

- Pay close attention to exclusions and limitations in each policy, as these can significantly impact the protection provided.

- Compare deductibles and any additional coverages offered by each insurer to determine the overall value of the policy.

Reviewing Customer Reviews and Satisfaction Ratings, How much is home insurance?

- Research customer reviews and ratings for each insurance company to gauge their reputation for customer service, claims processing, and overall satisfaction.

- Consider feedback from policyholders who have filed claims to understand how the insurer handles the process and resolves issues.

- Choose insurers with high customer satisfaction ratings and positive reviews to ensure a smooth experience in case of a claim.

Selecting the Best Home Insurance Policy for Individual Needs

- Assess your specific insurance needs based on your property type, location, and personal assets to determine the coverage amounts required.

- Consider bundling home and auto insurance policies for potential discounts and savings on premiums.

- Work with an insurance agent or broker to navigate the complexities of different policies and find the best coverage options for your unique situation.

In conclusion, How much is home insurance? is a multifaceted topic that demands attention to detail. By understanding the various factors influencing costs, types of coverage to consider, and money-saving tips, homeowners can make informed decisions to protect their most valuable asset. Stay informed, stay protected, and embrace the peace of mind that comes with a well-structured home insurance policy.

Expand your understanding about Custom home decor with the sources we offer.