Homeowners insurance basics sets the stage for this enthralling narrative, offering readers a glimpse into a story that is rich in detail with ahrefs author style and brimming with originality from the outset.

Exploring the importance of homeowners insurance, different coverage types, factors affecting premiums, filing a claim, and understanding policy limits are just a few aspects covered in this informative guide.

Importance of Homeowners Insurance: Homeowners Insurance Basics

Homeowners insurance is crucial for protecting one of the most significant investments a person can make – their home. It provides financial security and peace of mind in the event of unforeseen circumstances.

Protection Against Natural Disasters

Homeowners insurance can be a lifesaver in situations like hurricanes, wildfires, or earthquakes. Without proper insurance, homeowners could face devastating financial losses if their home is damaged or destroyed by a natural disaster.

Expand your understanding about Wall art for home decor with the sources we offer.

Liability Coverage

Another crucial aspect of homeowners insurance is liability coverage. In case someone gets injured on your property, this coverage can help cover medical expenses and legal fees. Without it, homeowners could be held personally responsible for these costs.

Theft and Vandalism

Homeowners insurance also provides coverage in case of theft or vandalism. If your belongings are stolen or your property is damaged by vandals, insurance can help cover the cost of repairs or replacements.

Coverage Types

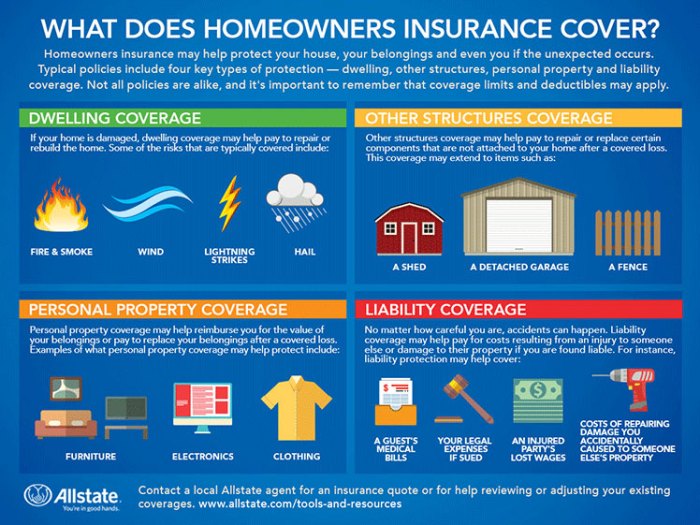

When it comes to homeowners insurance, there are different types of coverage included in policies to protect your home and belongings. Understanding these coverage types is essential in ensuring you have adequate protection in place.

Dwelling Coverage

Dwelling coverage is the most basic type of coverage included in homeowners insurance policies. It protects the structure of your home, including walls, roof, floors, and built-in appliances, against damage from covered perils such as fire, windstorm, or theft.

Personal Property Coverage

Personal property coverage protects your belongings inside the home, such as furniture, clothing, and electronics, in case they are damaged or stolen. It’s important to take inventory of your possessions to determine the appropriate coverage amount.

Liability Coverage

Liability coverage protects you in case someone is injured on your property and decides to sue you. It can help cover legal expenses, medical bills, and damages awarded in a lawsuit. This coverage is crucial for protecting your assets and financial well-being.

Additional Living Expenses Coverage

Additional living expenses coverage, also known as loss of use coverage, helps pay for temporary living expenses if your home becomes uninhabitable due to a covered loss. This can include hotel bills, restaurant meals, and other costs incurred while your home is being repaired.

Optional Coverages

In addition to the basic coverage types, homeowners can consider adding optional coverages to their policy for extra protection. These may include:

– Flood insurance

– Earthquake insurance

– Scheduled personal property coverage for high-value items like jewelry or art

– Identity theft coverage

– Sewer backup coverage

It’s important to review your policy and discuss with your insurance agent to determine which optional coverages are right for your specific needs and circumstances.

Factors Affecting Premiums

When it comes to homeowners insurance, several factors can impact the cost of premiums. Understanding these factors can help homeowners make informed decisions about their coverage and potentially save money on their insurance.

Location

The location of your home plays a significant role in determining your insurance premiums. Homes located in areas prone to natural disasters such as hurricanes, wildfires, or floods are considered high-risk and may result in higher premiums. Additionally, the crime rate in your neighborhood can also affect your rates.

Home Value

The value of your home is another crucial factor that insurers consider when calculating premiums. More expensive homes typically require higher coverage limits, resulting in increased premiums. Insurers will also take into account the cost of rebuilding or repairing your home in the event of damage or loss.

Deductible Amount, Homeowners insurance basics

The deductible amount is the out-of-pocket expense you agree to pay before your insurance coverage kicks in. Choosing a higher deductible can lower your premiums, as you are taking on more risk. However, it’s essential to ensure that you can afford the deductible amount in case of a claim.

Other Variables

Other variables that can impact your homeowners insurance premiums include the age and condition of your home, the materials used in construction, the presence of safety features such as smoke detectors or security systems, and even your credit score.

Ways to Lower Premiums

There are several strategies homeowners can use to potentially lower their insurance premiums. These include bundling policies with the same insurer, maintaining a good credit score, making home improvements to reduce risks, increasing your deductible, and shopping around for the best rates.

Filing a Claim

When it comes to filing a homeowners insurance claim, it’s crucial to understand the process to ensure a smooth and efficient resolution. Here’s a breakdown of the steps homeowners should take when filing a claim and how the claim is processed and resolved by the insurance company.

Step-by-Step Guide to Filing a Claim

- Contact your insurance company as soon as possible after the incident occurs. Provide them with all the necessary details, such as the date and time of the incident, a description of what happened, and any relevant documentation or evidence.

- An insurance adjuster will be assigned to assess the damage. Make sure to cooperate with the adjuster and provide them with access to your property for inspection.

- Document the damage by taking photos or videos to support your claim. Keep a record of any expenses incurred as a result of the incident.

- Review your policy to understand the coverage limits and exclusions. This will help you manage your expectations regarding the claim settlement.

- Once the claim is submitted, the insurance company will review the information provided and determine the validity of the claim. They may request additional documentation or information if needed.

Processing and Resolution of the Claim

- After the claim is reviewed, the insurance company will determine the amount of coverage you are entitled to based on the policy terms and the extent of the damage.

- The insurance company will provide a settlement offer outlining the compensation for the damages. You have the right to negotiate the offer if you feel it does not adequately cover your losses.

- Once an agreement is reached, the insurance company will issue the payment for the claim. Depending on the policy and the type of damage, the payment may be made in a lump sum or in installments.

- Keep in touch with your insurance company throughout the process to address any concerns or questions you may have. It’s essential to maintain open communication to ensure a satisfactory resolution.

Understanding Policy Limits

Policy limits in homeowners insurance refer to the maximum amount your insurance provider will pay out for covered losses. It is essential to understand these limits as they can greatly impact the extent of coverage you receive in different scenarios.

How Policy Limits Affect Coverage

- Policy limits determine the maximum amount you can claim for damages to your property or belongings. If your losses exceed these limits, you may have to cover the remaining costs out of pocket.

- Understanding your policy limits can help you make informed decisions about purchasing additional coverage or increasing existing limits to ensure adequate protection.

- In cases where policy limits are insufficient, you may face financial hardship or be unable to fully recover from a significant loss.

Examples of Crucial Understanding

- For instance, if your policy has a limit of $200,000 for dwelling coverage and your home sustains $250,000 in damages, you would be responsible for the $50,000 difference.

- If your personal property coverage limit is $50,000 and your belongings are stolen with a total value of $60,000, you would only be reimbursed up to the policy limit unless you have additional coverage in place.

- Being aware of policy limits can help you assess your coverage needs accurately and prevent any surprises or gaps in protection during a claim.

In conclusion, understanding the basics of homeowners insurance is essential for every homeowner to protect their investment and ensure financial security in times of need. By grasping the fundamentals discussed here, individuals can make informed decisions and safeguard their homes effectively.