Starting with Home insurance premiums, this article dives deep into the various factors affecting premiums, coverage options, ways to save money, and the impact of claims on future costs. Stay tuned for valuable insights!

Factors Affecting Home Insurance Premiums

When it comes to determining home insurance premiums, several factors come into play. These factors can significantly impact the cost of insuring your home and belongings, making it important to understand how they influence insurance costs.

Location

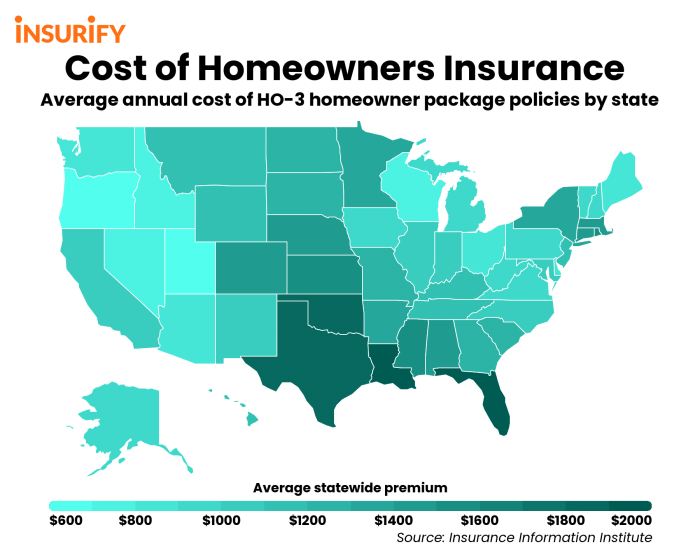

The location of your home plays a crucial role in determining your insurance premiums. Homes located in areas prone to natural disasters such as hurricanes, floods, or earthquakes are considered high-risk and may result in higher premiums. Additionally, the crime rate in your area can also affect your insurance costs.

Construction Materials

The materials used to build your home can also impact your insurance premiums. Homes constructed with fire-resistant materials such as brick or stone are less likely to suffer damage in case of a fire, resulting in lower insurance costs. On the other hand, homes made of wood or other flammable materials may lead to higher premiums due to increased risk.

Age of the Home

The age of your home is another factor that insurance companies consider when determining premiums. Older homes may have outdated electrical systems, plumbing, or roofing, increasing the risk of damage and potential claims. As a result, older homes may have higher insurance premiums compared to newer properties.

Security Systems and Proximity to Fire Hydrants

Having security systems such as alarms, deadbolts, or surveillance cameras can help lower your insurance premiums by reducing the risk of theft or vandalism. Similarly, living close to a fire hydrant or fire station can result in lower premiums as it can help mitigate fire damage in case of an emergency.

Overall, understanding how these factors influence home insurance premiums can help you make informed decisions when selecting coverage for your home.

Types of Coverage Offered

:max_bytes(150000):strip_icc()/homeowners-insurance-guide_final-88e7d3469dcc4920977498f08564b234.png?w=700)

When it comes to home insurance policies, there are various types of coverage options available to homeowners. Understanding the differences between basic coverage and additional riders or endorsements is crucial in ensuring that your home is adequately protected.

Basic Coverage vs. Additional Riders

Basic coverage in a standard home insurance policy typically includes protection for the structure of your home, personal belongings, liability coverage, and additional living expenses in case your home becomes uninhabitable due to a covered loss. However, there are certain perils and items that may not be fully covered under a standard policy, which is where additional riders or endorsements come into play.

- Earthquake and flood insurance: Standard home insurance policies usually do not cover damages caused by earthquakes or floods. Homeowners may need to purchase separate insurance policies or add endorsements to their existing policies to protect their homes from these specific perils.

- Jewelry, fine art, and other high-value items: While standard home insurance policies provide coverage for personal belongings, there are often limits on how much coverage is provided for high-value items such as jewelry and fine art. Homeowners can add riders to increase coverage limits for these items.

- Identity theft protection: Some insurance companies offer riders that provide coverage for expenses related to identity theft, such as legal fees and lost wages. This type of coverage is not typically included in standard home insurance policies.

Ways to Lower Home Insurance Premiums

When it comes to lowering your home insurance premiums, there are several strategies you can consider to help reduce your costs and save money in the long run.

One effective way to lower your home insurance premiums is by bundling your home and auto insurance policies with the same insurance company. Many insurance providers offer discounts for customers who choose to bundle multiple policies together, so be sure to inquire about potential savings by consolidating your coverage.

Another way to lower your home insurance premiums is by raising your deductibles. By opting for a higher deductible, you may be able to lower your monthly premiums. However, it’s important to ensure that you have enough savings set aside to cover the higher deductible in case you need to file a claim.

Maintaining a good credit score is also crucial in securing lower home insurance premiums. Insurance companies often take your credit score into consideration when calculating your premiums, so it’s important to stay on top of your finances and work towards improving your credit score to potentially qualify for lower rates.

Bundling Home and Auto Insurance

When you bundle your home and auto insurance policies with the same provider, you can often enjoy significant discounts on both policies. This can result in substantial savings on your overall insurance costs while simplifying your coverage management.

- Check with your insurance provider to see if they offer discounts for bundling home and auto policies.

- Compare quotes from different providers to find the best bundle deal that meets your coverage needs.

- Review your policies annually to ensure you’re still getting the best rates and coverage options.

Raising Deductibles

Increasing your deductibles can lead to lower monthly premiums, but it’s essential to weigh the potential savings against the risk of higher out-of-pocket expenses in the event of a claim.

- Calculate how much you could potentially save by raising your deductibles and adjust your policy accordingly.

- Set aside emergency savings to cover the higher deductible in case of an unexpected claim.

- Consider your risk tolerance and budget constraints when deciding on an appropriate deductible amount.

Maintaining a Good Credit Score

Insurance companies often use credit scores as a factor in determining premiums, so improving and maintaining a good credit score can help you qualify for lower rates on your home insurance.

- Regularly check your credit report for errors and work on improving your credit score over time.

- Pay your bills on time and keep your credit card balances low to boost your credit score.

- Communicate with your insurance provider to understand how your credit score impacts your premiums and what steps you can take to potentially lower your rates.

Claims Process and Impact on Premiums

When it comes to home insurance, understanding the claims process and its impact on premiums is crucial for homeowners. Filing a claim can have implications for future premium rates, so it is essential to be informed about how this process works.

Process of Filing a Home Insurance Claim

- Notify your insurance company: Contact your insurance provider as soon as possible after an incident occurs that may lead to a claim.

- Evaluate the damage: An adjuster will assess the damage and determine the coverage provided by your policy.

- Submit documentation: Provide any necessary documentation, such as photos or receipts, to support your claim.

- Receive compensation: If the claim is approved, you will receive compensation for the covered losses.

Impact of Filing Claims on Premiums

- Increased premiums: Filing multiple claims can lead to higher premiums as insurers may view you as a higher risk.

- Loss of discounts: Some insurers offer discounts for claim-free periods, which may be lost after filing a claim.

- Risk assessment: Insurers assess your claims history to determine your risk profile, which can impact future premium rates.

Situations Where Filing a Claim May Not Be Advisable, Home insurance premiums

- Minor damage: For minor repairs that may cost less than your deductible, it may be more cost-effective to handle the repairs yourself.

- Multiple recent claims: Filing multiple claims within a short period can result in steep premium increases.

- Non-covered losses: If the damage is not covered by your policy, filing a claim may not be beneficial and could still impact your premiums.

In conclusion, understanding how factors influence home insurance premiums, exploring different coverage options, implementing money-saving strategies, and being mindful of the claims process can all lead to a more informed and cost-effective insurance experience.

Remember to click Home insurance companies to understand more comprehensive aspects of the Home insurance companies topic.