Home insurance for renters sets the stage for this enthralling narrative, offering readers a glimpse into a story that is rich in detail with ahrefs author style and brimming with originality from the outset.

Understanding the importance of home insurance for renters, the coverage options available, factors influencing premiums, filing a claim, saving on insurance, and policy exclusions are all crucial aspects that will be explored in detail.

Understanding Home Insurance for Renters

Renters insurance is a type of insurance policy specifically designed for individuals who rent the property they live in. While landlords typically have insurance to cover the physical structure of the building, renters insurance is meant to protect the tenant’s personal belongings and provide liability coverage.

Why Renters Need Home Insurance

- Renters insurance covers personal belongings: In case of theft, fire, or other covered events, renters insurance can help replace or repair personal belongings such as furniture, electronics, and clothing.

- Liability protection: Renters insurance provides liability coverage in case someone is injured while visiting your rented property, or if you accidentally damage someone else’s property.

- Additional living expenses coverage: If your rental unit becomes uninhabitable due to a covered event, renters insurance can help cover additional living expenses such as hotel bills or temporary rentals.

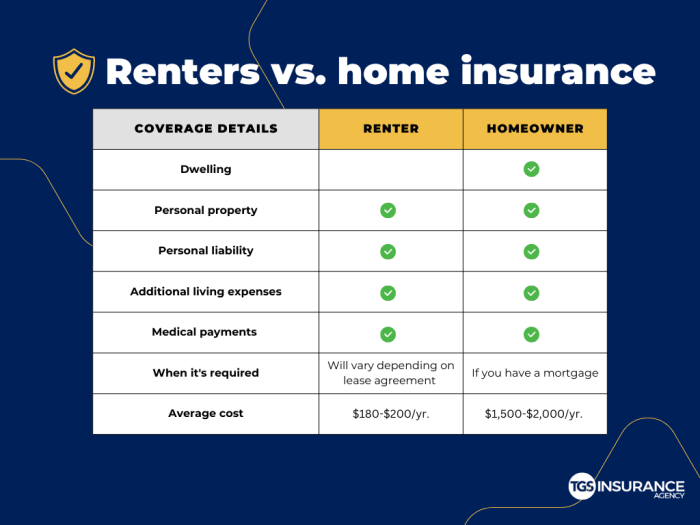

Comparison with Homeowners Insurance

- Property coverage: While homeowners insurance covers the physical structure of the home, renters insurance focuses on the tenant’s personal property and liability.

- Cost: Renters insurance is generally more affordable than homeowners insurance since it does not cover the entire property structure.

- Ownership: Homeowners insurance is necessary for individuals who own the property they live in, while renters insurance is specifically designed for tenants.

Coverage Options

When it comes to home insurance for renters, there are several coverage options available to protect your belongings and liability. It is essential for renters to understand these options to ensure they have adequate coverage in case of unforeseen events.

Liability Coverage

Liability coverage is a crucial component of home insurance for renters. This coverage protects you in case someone is injured while on your rental property or if you accidentally damage someone else’s property. It can help cover legal fees and medical expenses, providing you with financial protection in case of a lawsuit.

Additional Coverage Options

- Renters Insurance: This type of insurance provides coverage for your personal belongings in case of theft, fire, or other covered perils. It can also offer additional living expenses if you need to temporarily relocate due to a covered event.

- Flood Insurance: Standard renters insurance typically does not cover flood damage, so it may be beneficial to consider adding flood insurance to your policy if you live in a flood-prone area.

- Earthquake Insurance: Similar to flood insurance, earthquake coverage is not usually included in standard renters insurance. If you live in an earthquake-prone region, adding this coverage can help protect your belongings in case of seismic activity.

- Jewelry or Valuable Items Coverage: If you own expensive jewelry, artwork, or other valuable items, consider adding additional coverage to protect these items in case of theft or damage.

Factors Affecting Home Insurance Premiums

When it comes to determining the cost of home insurance for renters, several factors come into play. These factors can significantly impact the premiums that individuals pay to protect their rented living space and personal belongings.

Location Impact on Insurance Premiums

The location of the rental property is a crucial factor that influences home insurance premiums. Urban areas with higher crime rates or increased risk of natural disasters such as hurricanes, earthquakes, or wildfires tend to have higher insurance costs. Additionally, proximity to fire stations, flood zones, and other risk factors can also impact premiums. Insurers assess the overall risk associated with the location to determine the likelihood of filing a claim, which directly affects the premium amount.

Value of Personal Belongings and Premiums

The value of personal belongings plays a significant role in determining home insurance premiums for renters. The more valuable the items within the rental property, the higher the insurance coverage needed to protect them adequately. Expensive electronics, jewelry, artwork, and other valuable possessions will increase the overall cost of insurance. Renters can choose to add additional coverage for high-value items through endorsements or scheduled personal property coverage, but this will also lead to higher premiums.

Filing a Claim

When it comes to filing a home insurance claim for renters, it is essential to understand the process and know what steps to take in case of damage or loss. Being prepared can help streamline the process and ensure that you receive the necessary assistance from your insurance provider.

Tips for Filing a Claim

- Contact your insurance provider as soon as possible after the damage or loss occurs to start the claims process.

- Document the damage with photos or videos to provide evidence for your claim.

- Keep records of any communication with your insurance company, including claim numbers and adjuster information.

- Provide a detailed inventory of the items that were damaged or lost, including their value and any receipts if available.

- Follow up with your insurance provider to ensure that your claim is being processed in a timely manner.

Common Mistakes to Avoid

- Delaying the claim process can lead to complications, so make sure to report the damage promptly.

- Exaggerating the extent of the damage or loss can result in delays or denial of your claim, so be honest and provide accurate information.

- Failing to review your policy coverage before filing a claim may lead to misunderstandings about what is included in your insurance plan.

- Not seeking guidance from your insurance provider on the claim process and requirements can lead to confusion or mistakes that could affect your claim.

- Neglecting to follow up on the status of your claim may result in delays in receiving compensation for the damages or losses you have experienced.

Tips for Saving on Home Insurance: Home Insurance For Renters

When it comes to saving on home insurance as a renter, there are several strategies you can implement to lower your premiums and maximize your coverage. From bundling insurance policies to improving home security measures, these tips can help you find cost-effective solutions for your insurance needs.

Bundling Insurance Policies

One effective way to save on home insurance as a renter is by bundling your insurance policies. By combining your renters insurance with other policies such as auto insurance or life insurance, you can often receive a discounted rate from your insurance provider. This not only helps you save money but also simplifies the insurance process by managing all your policies under one provider.

Improving Home Security

Another way to reduce your home insurance costs is by enhancing your home security measures. Installing security systems, deadbolts, smoke detectors, and fire alarms can lower the risk of potential damages or theft, which can lead to lower insurance premiums. Additionally, living in a secure neighborhood or gated community can also positively impact your insurance rates.

Understanding Policy Exclusions

:max_bytes(150000):strip_icc()/whats-difference-between-renters-insurance-and-homeowners-insurance-v2-2694bc76e944405aa55fe2784c373999.png?w=700)

When it comes to home insurance for renters, it is crucial to understand the policy exclusions to ensure you have adequate coverage in place. Policy exclusions are specific situations or events that are not covered by your insurance policy, so it’s essential to read the policy carefully to know what is included and excluded.

Common Exclusions in Home Insurance Policies for Renters

- Damage caused by floods or earthquakes: Most standard renters insurance policies do not cover damage caused by natural disasters like floods or earthquakes. If you live in an area prone to these events, you may need to purchase additional coverage.

- Intentional damage: Any damage caused intentionally by the policyholder or any other insured individual is typically not covered by home insurance.

- Neglect or lack of maintenance: If damage occurs due to neglect or lack of maintenance of the rented property, it may not be covered by your insurance policy.

- Business-related activities: Damage or liability arising from business activities conducted in your rented property may not be covered by standard renters insurance.

Importance of Reading the Policy Carefully

It is essential to carefully review your insurance policy to understand the exclusions and limitations of coverage. By knowing what is not covered, you can take steps to address any gaps in coverage and avoid surprises when filing a claim.

Examples of Situations That May Not Be Covered, Home insurance for renters

- If your belongings are damaged due to a flood and you do not have flood insurance, the cost of replacing these items may not be covered by your renters insurance policy.

- If you intentionally cause damage to your rental property, such as punching a hole in the wall, the cost of repairs may not be covered by your insurance.

- If your rental property suffers damage due to lack of maintenance, such as a leaky roof that you failed to report, the cost of repairs may not be covered by your insurance policy.

In conclusion, home insurance for renters is a vital aspect of ensuring protection and peace of mind for those living in rented properties. By understanding the various coverage options, factors affecting premiums, and how to file a claim, renters can make informed decisions to safeguard their belongings and property.

Obtain direct knowledge about the efficiency of Wall art for home decor through case studies.