Home insurance coverage options encompass a variety of choices for homeowners, from basic to specialized coverage. Let’s dive into the details to understand the ins and outs of protecting your home and belongings.

In this comprehensive guide, we will walk you through the different types of coverage available, additional options to consider, and ways to save on premiums. So, let’s unravel the mysteries of home insurance together.

Types of Home Insurance Coverage

When it comes to home insurance, there are different types of coverage options available to homeowners. Understanding these options can help you choose the right policy that suits your needs and budget.

Basic Coverage

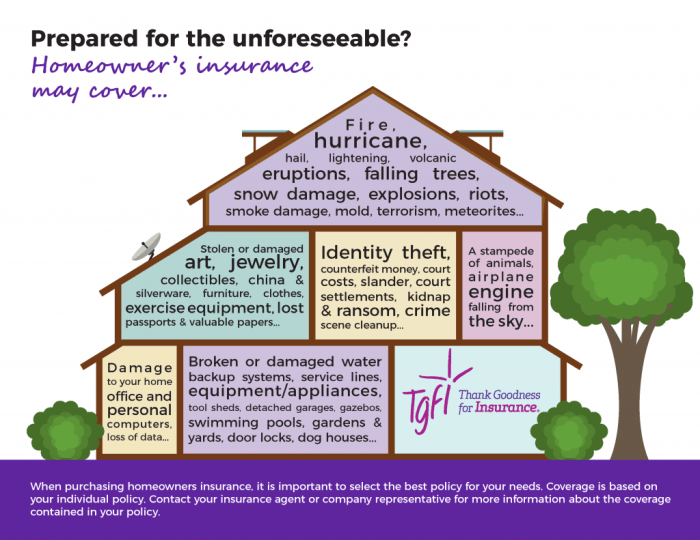

Basic home insurance coverage typically includes protection for your dwelling, personal property, liability, and additional living expenses in case your home becomes uninhabitable due to a covered event. It provides financial protection against common risks such as fire, theft, and vandalism.

- Dwelling Coverage: This protects the physical structure of your home, including the walls, roof, floors, and built-in appliances.

- Personal Property Coverage: This covers your belongings inside the home, such as furniture, clothing, and electronics.

- Liability Coverage: This protects you in case someone is injured on your property and you are found legally responsible.

- Additional Living Expenses: If you need to temporarily live elsewhere while your home is being repaired, this coverage helps with the costs.

Comprehensive Coverage

Comprehensive home insurance coverage offers broader protection than basic coverage. In addition to the standard coverage options mentioned above, it may include coverage for other perils like water damage, mold, and natural disasters. While comprehensive coverage typically comes at a higher cost, it provides more extensive protection for your home and belongings.

- Water Damage Coverage: Protects against damage caused by leaks, burst pipes, or flooding.

- Mold Coverage: Covers the costs of mold remediation and repairs due to mold infestation.

- Natural Disaster Coverage: Offers protection against events like earthquakes, hurricanes, and tornadoes.

Additional Coverage Options

:max_bytes(150000):strip_icc()/homeowners-insurance-guide_final-88e7d3469dcc4920977498f08564b234.png?w=700)

When it comes to protecting your home, standard insurance coverage may not always be enough. That’s why many insurance companies offer additional coverage options that homeowners can add to their policies for extra protection. These optional add-ons can provide financial security in case of specific events or damages not covered by a basic policy.

Flood Insurance

Flood insurance is a specialized coverage option that protects homeowners in the event of flood damage to their property. Standard home insurance policies typically do not cover flood damage, so adding this coverage can be crucial, especially for those living in flood-prone areas. Flood insurance can help cover the cost of repairing or replacing damaged property, including flooring, walls, and personal belongings.

Earthquake Insurance

Earthquake insurance is another optional coverage add-on that homeowners can consider, particularly if they live in regions prone to seismic activity. This type of insurance can help cover the cost of repairing or rebuilding a home damaged by an earthquake, as well as replacing personal property affected by the disaster. Without earthquake insurance, homeowners may face significant financial burdens in the aftermath of such a catastrophic event.

Coverage Limits and Deductibles

When it comes to home insurance, coverage limits and deductibles play a crucial role in determining the extent of protection and the out-of-pocket expenses in case of a claim.

Coverage Limits

Home insurance policies typically have coverage limits, which are the maximum amounts an insurance company will pay for covered losses. These limits can vary depending on the type of coverage and the specific policy details. It’s essential for homeowners to review their policy carefully to understand these limits and ensure they have adequate coverage.

Deductibles

Deductibles refer to the amount of money a policyholder must pay out of pocket before their insurance kicks in to cover a claim. For example, if a policy has a $1,000 deductible and the insured suffers a covered loss of $5,000, they would need to pay $1,000 before the insurance company covers the remaining $4,000. Choosing a higher deductible can lower insurance premiums, but it also means higher out-of-pocket costs in the event of a claim.

Understand how the union of Boho home decor can improve efficiency and productivity.

Impact of Deductibles on Insurance Costs

- Low Deductible: Opting for a lower deductible, such as $500, can result in higher premiums but lower out-of-pocket expenses at the time of a claim. This can be beneficial for homeowners who prefer predictability in their expenses.

- High Deductible: Choosing a higher deductible, such as $2,000, can lead to lower premiums but higher out-of-pocket costs in the event of a claim. This option may be suitable for homeowners who are willing to take on more financial risk to save on monthly insurance costs.

- Considerations: When deciding on a deductible amount, homeowners should assess their financial situation, risk tolerance, and ability to cover the deductible amount if a claim occurs.

Personal Property Coverage

When it comes to home insurance, personal property coverage is a crucial component that protects your belongings in case of damage or theft. This coverage extends to items such as furniture, electronics, clothing, and other personal possessions within your home.

What does personal property coverage include?

- Personal property coverage typically includes items like furniture, clothing, electronics, appliances, and other personal belongings.

- It helps cover the cost of repairing or replacing these items if they are damaged or stolen due to covered perils.

- Some policies may also provide coverage for personal items damaged or stolen outside of the home, such as belongings in your car or luggage while traveling.

Tips for inventorying personal belongings for insurance purposes

- Create a detailed inventory of your personal belongings, including descriptions, photos, and receipts if possible.

- Store this inventory in a safe place, such as a cloud storage service or a safe deposit box, to ensure it is easily accessible in case you need to file a claim.

- Update your inventory regularly as you acquire new items or get rid of old ones to ensure your coverage accurately reflects your belongings.

Common misconceptions about personal property coverage

- One common misconception is that personal property coverage only applies to high-value items. In reality, it covers a wide range of belongings, from clothing to electronics.

- Another misconception is that personal property coverage will automatically provide full replacement cost for damaged items. Some policies may factor in depreciation, so it’s essential to understand the terms of your coverage.

- Some homeowners mistakenly believe that personal property coverage is unnecessary if they don’t own valuable items. However, the cost of replacing everyday items can add up quickly, making this coverage essential for most homeowners.

Liability Coverage

Liability coverage is a crucial component of home insurance as it protects you financially in case someone is injured on your property or if you accidentally damage someone else’s property.

Importance of Liability Coverage

Liability coverage provides financial protection and legal defense if you are held responsible for injuries or damages to others. Without this coverage, you could be personally liable for costly medical bills, legal fees, and settlements.

Situations Requiring Liability Coverage

- Guests slipping and falling on your property.

- Your dog biting someone.

- Accidentally damaging your neighbor’s property while mowing the lawn.

Determination of Liability Coverage Limits

The amount of liability coverage you need depends on various factors such as the value of your assets, risk factors on your property, and potential legal expenses. It is recommended to have enough coverage to protect your assets in case of a lawsuit.

Discounts and Savings

When it comes to home insurance, there are several ways homeowners can save money on their insurance premiums. By taking advantage of discounts and bundling options, you can ensure you are getting the best value for your coverage.

Discount Options

- Multi-Policy Discount: Many insurance companies offer a discount when you bundle your home and auto insurance policies together.

- Claims-Free Discount: If you have not filed any claims in a certain period, you may be eligible for a discount on your premium.

- Security System Discount: Installing a security system in your home can lower your insurance costs.

- New Home Discount: Some insurers offer discounts for homes that are less than a certain number of years old.

Understanding Exclusions: Home Insurance Coverage Options

When it comes to home insurance policies, it’s crucial to understand what is not covered. Exclusions are specific items or incidents that your policy will not provide coverage for. Knowing these exclusions can help you better assess your risk and take necessary precautions.

Common Exclusions in Home Insurance Policies

- Earth movement: Damage caused by earthquakes, landslides, or sinkholes may not be covered.

- Floods: Most standard policies do not cover damage from flooding, requiring a separate flood insurance policy.

- Wear and tear: Normal wear and tear, maintenance issues, and gradual deterioration are typically not covered.

- Neglect: Damage resulting from neglecting to maintain your property may not be covered.

- Intentional damage: Any damage caused intentionally by you or a member of your household will not be covered.

Why Certain Items or Incidents May Not Be Covered

- Insurance is designed to protect against sudden and accidental events, not predictable or preventable issues.

- Exclusions help keep insurance premiums affordable by excluding high-risk items or incidents.

- Some exclusions are based on the availability of specialized coverage, such as flood insurance.

Tips on How to Mitigate Risks for Excluded Items, Home insurance coverage options

- Regular maintenance: Keeping your home well-maintained can prevent issues related to wear and tear.

- Secure additional coverage: Consider purchasing separate policies for excluded items like floods or earthquakes.

- Understand your policy: Review your policy to fully comprehend what is covered and excluded.

Renewal and Review Process

When it comes to home insurance, renewing your policy and reviewing your coverage periodically are essential steps to ensure you have adequate protection for your home and belongings. Let’s delve into the process of renewing a home insurance policy and why reviewing it regularly is crucial.

Renewing Your Policy

Renewing your home insurance policy typically involves receiving a renewal notice from your insurance company before your current policy expires. This notice will Artikel any changes in coverage, premiums, or deductibles for the upcoming policy period. To renew, you usually need to pay the renewal premium by the specified deadline to ensure continuous coverage.

Importance of Reviewing Coverage Periodically

Reviewing your home insurance coverage periodically is crucial to ensure that your policy reflects any changes in your home, belongings, or lifestyle. Factors such as renovations, additions, or upgrades to your home may require adjustments to your coverage limits to adequately protect your investment. Additionally, changes in the value of your personal property or liability risks may necessitate updates to your policy to ensure you have sufficient coverage.

Tips for Reviewing and Renewing Home Insurance

- Review your policy annually: Take the time to review your home insurance policy at least once a year to ensure it aligns with your current needs and circumstances.

- Assess coverage limits: Evaluate whether your coverage limits are adequate to protect your home, belongings, and assets in the event of a covered loss.

- Consider deductible amounts: Review your deductible amounts and assess whether you can afford to pay the out-of-pocket costs in the event of a claim.

- Update personal information: Make sure your insurance company has accurate information about your home, belongings, and any changes in occupancy to avoid coverage gaps.

- Explore discounts: Inquire about any new discounts or savings opportunities that may be available to you based on changes in your circumstances or eligibility for additional discounts.

As we conclude our exploration of home insurance coverage options, remember the importance of reviewing your policy regularly to ensure you have the right level of protection. With the right knowledge and understanding, you can make informed decisions to safeguard your home and assets.