Flood insurance coverage is a crucial aspect that every homeowner should understand. From the importance of having it to the types of policies available, this comprehensive guide will walk you through everything you need to know.

Explore the risks of not having flood insurance coverage and learn how you can potentially lower your premiums. Let’s dive into the world of flood insurance coverage and ensure you’re well-equipped to protect your home.

Importance of Flood Insurance Coverage

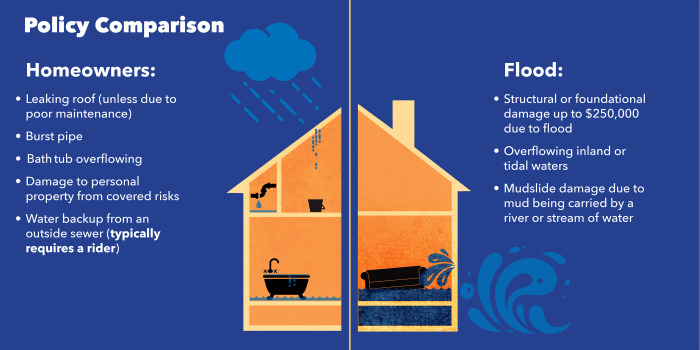

When it comes to protecting your home and belongings, having flood insurance coverage is crucial. While some homeowners may believe that their standard homeowner’s insurance policy covers flood damage, this is often not the case. Flood insurance provides financial protection in the event of flood-related losses, which can be devastating and costly.

Find out further about the benefits of Home decor inspiration that can provide significant benefits.

Protection Against Unforeseen Events

Floods can occur anywhere, not just in high-risk flood zones. Even a few inches of water can cause significant damage to your property, leading to expensive repairs and replacements. Having flood insurance ensures that you are financially covered in case of such unforeseen events.

- Without flood insurance, you may have to bear the full cost of repairing or replacing your home and belongings after a flood.

- Flood insurance can help you recover more quickly and get back on your feet after a flood, minimizing the financial burden on you and your family.

- Even if you live in a low to moderate-risk area, having flood insurance provides peace of mind knowing that you are protected no matter what.

Risks of Not Having Flood Insurance Coverage

Not having flood insurance coverage can leave you vulnerable to significant financial losses in the event of a flood. Here are some risks associated with not having flood insurance:

- Many standard homeowner’s insurance policies do not cover flood damage, leaving you with no financial recourse in the event of a flood.

- Government assistance after a flood may be limited and may not be sufficient to cover all your losses.

- Repairing and replacing your home and belongings after a flood can be extremely costly and may put you in a difficult financial situation.

Types of Flood Insurance Policies

Flood insurance policies come in various types, each offering different coverage options and benefits. Understanding the differences between private flood insurance and the National Flood Insurance Program (NFIP) is crucial in making an informed decision about your flood insurance coverage.

Private Flood Insurance, Flood insurance coverage

Private flood insurance is offered by private insurance companies and provides coverage for flooding events. Unlike the NFIP, private flood insurance policies may offer higher coverage limits and additional benefits, but the cost can vary significantly depending on the provider and the property’s location. It is essential to carefully review the terms and conditions of a private flood insurance policy to ensure it meets your specific needs.

National Flood Insurance Program (NFIP)

The NFIP is a government-run program that provides flood insurance to property owners, renters, and businesses in participating communities. NFIP policies have set coverage limits and typically cover the structure of the property and its contents. However, NFIP policies may have limitations on coverage for certain items, such as basement improvements and outdoor property.

Coverage Limits and Exclusions

Standard flood insurance policies, whether private or through the NFIP, have coverage limits and exclusions that policyholders should be aware of. Coverage limits determine the maximum amount the policy will pay for covered losses, while exclusions specify what is not covered under the policy. Common exclusions may include damage caused by earth movement, sewer backup, or gradual water seepage.

Factors Affecting Flood Insurance Premiums: Flood Insurance Coverage

When it comes to flood insurance premiums, several factors come into play that can influence the cost homeowners have to pay. Understanding these factors is crucial for homeowners to make informed decisions about their coverage. Let’s delve into the key factors that affect flood insurance premiums.

Location

The location of a property is a significant factor in determining flood insurance premiums. Properties located in high-risk flood zones are likely to have higher premiums compared to those in low or moderate-risk areas. The proximity to bodies of water, historical flood data, and elevation level all play a role in assessing the risk of flooding for a property.

Property Value

The value of the property also impacts flood insurance premiums. Higher valued properties typically require more coverage, leading to higher premiums. It’s essential for homeowners to accurately assess the value of their property to ensure they have adequate coverage without overpaying for insurance.

Flood Risk Zone

Properties located in FEMA-designated flood zones are categorized based on their risk of flooding. The flood risk zone a property falls under directly influences the premium rates. Homes in high-risk zones will have higher premiums compared to those in low or moderate-risk zones. It’s crucial for homeowners to be aware of their property’s flood risk zone to understand how it affects their insurance costs.

Tips to Lower Premiums

– Elevate utilities and appliances to reduce the risk of flood damage.

– Install flood openings in the foundation to allow water to flow through and prevent structural damage.

– Consider mitigating measures such as installing flood barriers or sump pumps to lower the risk of flooding.

– Opt for a higher deductible to lower premium costs, but ensure you have the financial means to cover the deductible in case of a claim.

– Compare quotes from different insurance providers to find the most competitive rate for your property.

Filing a Flood Insurance Claim

When it comes to filing a flood insurance claim, it is essential to follow the necessary steps and provide the required documentation to ensure a smooth process and timely reimbursement.

Steps Involved in Filing a Flood Insurance Claim

- Contact your insurance agent or company as soon as possible after the flood damage occurs.

- Provide details about the extent of the damage and any personal property affected by the flood.

- Document the damage by taking photos or videos to support your claim.

- Fill out the necessary claim forms provided by your insurance company.

- Submit all required documentation promptly to expedite the processing of your claim.

Documentation Required to Support a Flood Insurance Claim

- Proof of loss form detailing the items damaged or lost in the flood.

- Receipts, invoices, or estimates for repairs or replacements of damaged property.

- Photographic or video evidence of the flood damage.

- Any other relevant documentation requested by your insurance company.

Tips to Expedite the Flood Insurance Claim Process

- Respond promptly to any requests or inquiries from your insurance company.

- Keep detailed records of all communication and documentation related to your claim.

- Stay organized and maintain copies of all paperwork submitted to your insurance company.

- Work closely with your adjuster to ensure all necessary information is provided for a thorough evaluation of your claim.

- Follow up regularly with your insurance company to check on the status of your claim and address any issues promptly.

In conclusion, understanding flood insurance coverage is vital in safeguarding your home from potential disasters. By knowing the types of policies available and factors affecting premiums, you can make informed decisions to protect your property. Stay informed, stay protected.