Tips for saving on home insurance takes center stage in this comprehensive guide, offering valuable insights on how to lower insurance premiums while maximizing coverage benefits. From understanding key factors that influence costs to exploring effective strategies for reducing expenses, this article is your go-to resource for saving money on your home insurance policy.

Explore the following tips and tricks to ensure you’re getting the best deal on your home insurance coverage.

Factors influencing home insurance costs

When it comes to home insurance costs, several key factors come into play that can influence the overall premium you pay. Factors such as location, home value, security measures, credit score, and claims history all play a role in determining how much you will pay for home insurance.

Location

The location of your home is a significant factor that insurance companies consider when determining your premium. Homes located in areas prone to natural disasters such as hurricanes, earthquakes, or wildfires may have higher insurance costs due to the increased risk of damage.

Home Value

The value of your home is another crucial factor in determining your insurance costs. More expensive homes typically require higher coverage limits, which can result in higher premiums. The age and condition of your home also play a role in determining its value and ultimately, your insurance costs.

Security Measures

Security measures such as having a home security system, smoke detectors, or deadbolts can help lower your insurance premiums. These measures reduce the risk of theft, fire, or other damage, making your home less risky to insure.

Credit Score and Claims History

Your credit score and claims history can also impact how much you pay for home insurance. Insurance companies may use your credit score to assess your risk level as a policyholder. Additionally, if you have a history of filing claims, especially for high-value items, you may be considered a higher risk and face higher premiums as a result.

Tips for reducing home insurance premiums

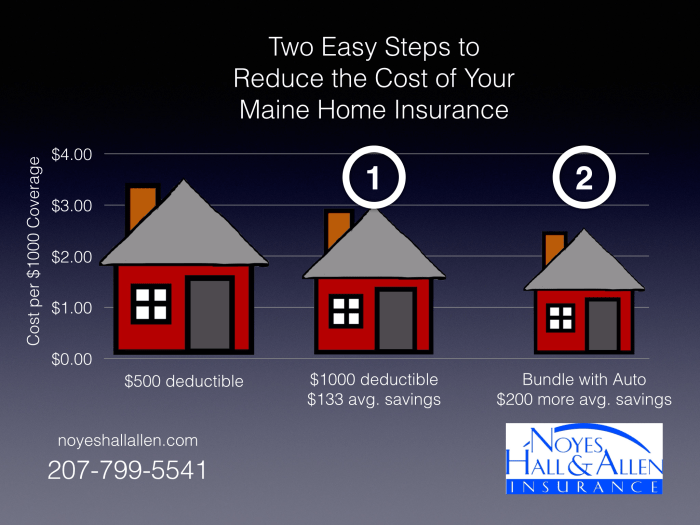

When looking to lower your home insurance costs, there are several strategies you can consider. One effective way is by bundling your home and auto insurance policies with the same provider. This can often lead to discounts on both policies, ultimately saving you money in the long run.

Benefits of bundling home and auto insurance policies

By combining your home and auto insurance policies, you can often qualify for a multi-policy discount from insurance companies. This discount can result in significant savings on your overall insurance premiums. Additionally, bundling your policies can simplify your insurance management by having all your coverage under one provider.

Improving home security systems for premium discounts

Investing in home security systems such as alarm systems, deadbolts, and security cameras can help reduce the risk of theft or damage to your property. Insurance companies often offer discounts for homes with enhanced security features, as they are considered lower risk. By improving your home’s security, you can not only increase your safety but also potentially lower your insurance premiums.

Understanding coverage options: Tips For Saving On Home Insurance

When it comes to home insurance, understanding the coverage options available is crucial in order to make informed decisions that best suit your needs and budget. Let’s explore the different types of coverage options and how to choose the right one for you.

Types of coverage options

- Basic coverage: Basic home insurance typically includes coverage for the structure of your home, personal belongings, liability protection, and additional living expenses in case you need to temporarily relocate due to a covered loss.

- Additional coverage options: In addition to basic coverage, you may also consider adding extra protection such as flood insurance, earthquake insurance, or personal property coverage for high-value items like jewelry or art.

Choosing the right coverage, Tips for saving on home insurance

- Assess your needs: Evaluate the value of your home, personal belongings, and potential risks in your area to determine the level of coverage you require.

- Consider your budget: While it’s important to have adequate coverage, it’s also essential to consider your budget and find a balance between protection and affordability.

- Review policy details: Carefully review the coverage limits, deductibles, and exclusions of each policy to ensure it aligns with your needs and provides sufficient protection.

Making home improvements for insurance savings

:max_bytes(150000):strip_icc()/getting-your-first-home-insurance-policy-4040509_FINAL-f4d13668216345e6bdc64bbea77b2fa8.png?w=700)

When it comes to saving on home insurance, making certain improvements to your property can lead to potential discounts on your premiums. By investing in upgrades that reduce risk and improve the overall safety and security of your home, insurance companies may view your property as less likely to file a claim, resulting in cost savings for you.

Home Improvements for Insurance Discounts

- Installing a new roof: A new roof can increase the structural integrity of your home and reduce the risk of damage from storms or leaks, leading to lower insurance premiums.

- Upgrading electrical systems: Updating outdated electrical systems can lower the risk of fire hazards, making your home safer and potentially reducing insurance costs.

- Adding a security system: Installing a security system with features like cameras, motion sensors, and alarms can deter burglaries and vandalism, resulting in insurance discounts.

- Upgrading plumbing: Updating plumbing systems can prevent water damage and leaks, which are common causes of insurance claims, leading to potential savings.

The Importance of Regular Home Maintenance

Regular home maintenance is crucial in preventing claims and maintaining lower insurance costs. By staying on top of repairs, inspections, and upkeep, you can address potential issues before they escalate into costly damages. Simple tasks like cleaning gutters, checking for leaks, and maintaining appliances can help you avoid claims and keep your insurance premiums affordable.

In conclusion, implementing these tips can help you secure affordable home insurance without compromising on coverage. By understanding the factors that influence costs, exploring different coverage options, and making strategic home improvements, you can protect your home while saving money in the process. Take charge of your insurance expenses today and enjoy peace of mind knowing you have the coverage you need at a price you can afford.

Explore the different advantages of Bundle home and auto insurance that can change the way you view this issue.