Home insurance claims process is a crucial aspect for policyholders, outlining the necessary steps from filing a claim to settlement. This guide provides valuable insights into the complexities of navigating through insurance claims.

Overview of Home Insurance Claims Process

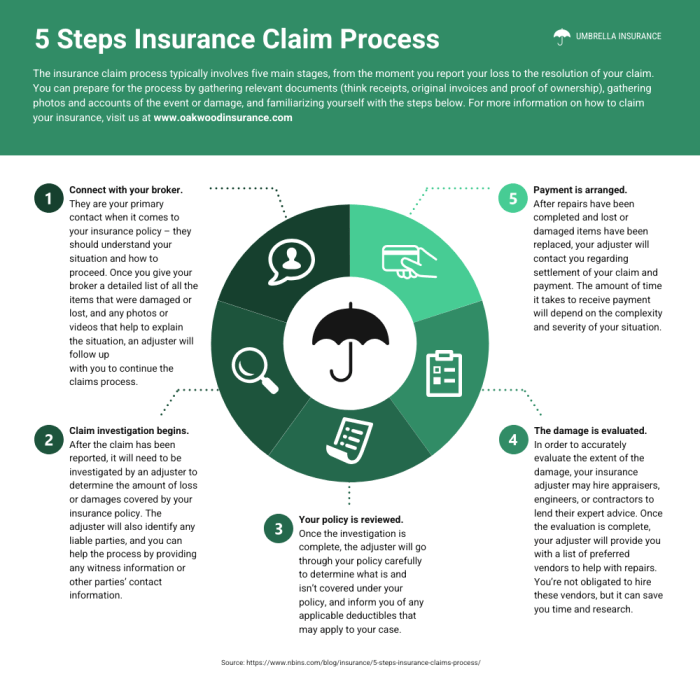

When it comes to filing a home insurance claim, there are several important steps that policyholders need to follow in order to ensure a smooth process. Understanding the claims process is crucial for policyholders as it can help them navigate the complexities of insurance coverage and maximize their benefits in case of a loss. Insurance companies handle claims from start to finish by assessing the damage, determining coverage, and processing payments to policyholders.

Steps Involved in Filing a Home Insurance Claim

- Contact your insurance company as soon as possible after a loss occurs to report the claim and provide necessary details.

- Document the damage by taking photos or videos to support your claim and provide evidence to the insurance company.

- Get estimates for repairs and replacement costs from contractors or professionals to submit to the insurance company.

- Cooperate with the insurance company’s adjuster who will assess the damage and determine the coverage for your claim.

- Review the settlement offer from the insurance company and negotiate if necessary to ensure fair compensation for your loss.

Importance of Understanding the Claims Process for Policyholders

Policyholders need to understand the claims process to ensure they receive the full benefits of their insurance coverage and avoid any potential pitfalls that could delay or deny their claim. By knowing how to properly file a claim, provide documentation, and communicate with the insurance company, policyholders can expedite the claims process and receive timely compensation for their losses.

Notice Cheap home insurance rates for recommendations and other broad suggestions.

How Insurance Companies Handle Claims from Start to Finish

- Upon receiving a claim, the insurance company assigns an adjuster to assess the damage and determine the coverage based on the policy terms.

- The adjuster investigates the claim by reviewing documentation, inspecting the property, and consulting with experts to validate the loss.

- Once the coverage is determined, the insurance company processes the claim and issues a settlement offer to the policyholder.

- If the policyholder accepts the settlement offer, the insurance company disburses the payment to cover the loss and close the claim.

- If there are disputes or disagreements, the policyholder and insurance company may enter into negotiations or mediation to resolve the issues and reach a fair settlement.

Documentation Required for Home Insurance Claims: Home Insurance Claims Process

When filing a home insurance claim, it is crucial to provide the necessary documentation to support your case and ensure a smooth claims process. Having the right paperwork can expedite the review and approval of your claim, leading to a faster resolution of your insurance issues.

Key Documents Needed for Home Insurance Claims

- Policies and Coverage Details: Your insurance policy documents outlining the coverages and limits of your home insurance.

- Proof of Loss: A detailed list of items damaged or lost in the incident, including their value and age.

- Police Report: In case of theft or vandalism, a police report documenting the incident is essential.

- Receipts and Invoices: Proof of purchase for damaged or stolen items to validate their value.

- Repair Estimates: Quotes from contractors or repair professionals estimating the cost of damages.

Significance of Providing Accurate and Detailed Documentation

Accurate and detailed documentation is crucial for home insurance claims as it helps insurance adjusters assess the validity of your claim. Providing precise information about the items damaged or lost, along with their value, ensures that you receive fair compensation for your losses. Inaccurate or incomplete documentation may lead to delays or denials in your claims process.

Photographs and Videos Supporting Home Insurance Claims

- Visual Evidence: Photographs and videos can provide visual proof of the damages incurred, making it easier for insurance adjusters to evaluate the extent of the loss.

- Before and After: Having images of your property before and after the incident can also help demonstrate the impact of the damage and the need for repairs or replacements.

- Documentation of Personal Belongings: Taking pictures of your belongings can help verify their existence and condition, aiding in the claims process.

Evaluation and Assessment of Home Insurance Claims

When it comes to evaluating and assessing home insurance claims, insurance adjusters play a crucial role in determining the extent of damage and coverage for policyholders. They follow a systematic process to ensure fair and accurate settlements.

Role of Inspections in the Claims Process

Inspections are a fundamental part of the claims process, allowing adjusters to physically assess the damage to the property. During inspections, adjusters inspect the property, take photographs, gather evidence, and assess the extent of the damage. This information is crucial in determining the coverage and payout for the claim.

Methods Used to Evaluate Home Insurance Claims

There are different methods used to evaluate home insurance claims, including on-site visits and virtual assessments.

- On-site visits: Adjusters visit the property in person to inspect the damage, assess the extent of the loss, and gather evidence to support the claim. This method allows for a thorough evaluation of the damage and provides a more accurate assessment.

- Virtual assessments: In some cases, adjusters may conduct virtual assessments using technology such as video calls, photos, and satellite imagery. While virtual assessments can be convenient and efficient, they may not always provide a comprehensive view of the damage, leading to potential inaccuracies in the evaluation.

Settlement and Resolution of Home Insurance Claims

When it comes to settling home insurance claims, several factors come into play that influence the final settlement amount. These factors include the extent of damage or loss, the terms and conditions of the insurance policy, the deductible amount, and the coverage limits set by the policy.

Factors Influencing Settlement Amount, Home insurance claims process

- The extent of damage or loss: The severity of the damage or loss to the insured property will directly impact the settlement amount. Insurance adjusters will assess the damage and determine the appropriate compensation.

- Policy terms and conditions: The specific terms and conditions Artikeld in the insurance policy will dictate what is covered and to what extent. Policyholders should review their policy carefully to understand their coverage.

- Deductible amount: The deductible is the amount that the policyholder is responsible for paying out of pocket before the insurance company covers the rest. A higher deductible typically results in a lower settlement amount.

- Coverage limits: Insurance policies have limits on the amount of coverage provided for certain categories of belongings or damages. Policyholders should be aware of these limits when filing a claim.

Negotiation Process

- Policyholders and insurance companies may enter into a negotiation process if there is a disagreement over the settlement amount. Both parties can present evidence, documentation, and estimates to support their position.

- Insurance adjusters play a crucial role in this process, as they assess the damage, review the policy terms, and negotiate with the policyholder to reach a fair settlement.

Timelines for Claim Resolution

- Timelines for claim resolution and payment disbursement can vary depending on the complexity of the claim, the responsiveness of the parties involved, and the efficiency of the insurance company’s claims processing.

- Generally, insurance companies aim to resolve claims promptly and efficiently. Policyholders should be proactive in providing all necessary documentation to expedite the process.

- Once a settlement amount is agreed upon, insurance companies typically disburse payment within a reasonable timeframe specified in the policy.

In conclusion, understanding the home insurance claims process is essential for policyholders to ensure a smooth and efficient resolution. By following the Artikeld steps and tips, individuals can better navigate through the complexities of filing a home insurance claim.