What does home insurance cover? This question opens the door to a world of protection and security for homeowners. From safeguarding your dwelling to covering personal property and liability, home insurance offers a safety net in times of uncertainty. Let’s delve into the details of what home insurance encompasses and why it’s crucial for every homeowner.

Overview of Home Insurance Coverage: What Does Home Insurance Cover?

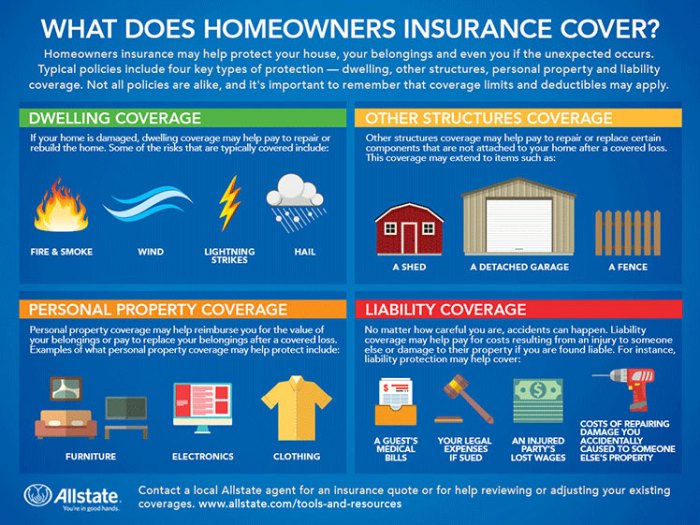

Home insurance is a type of property insurance that provides financial protection against damages to your home and belongings. It typically covers losses and damages caused by perils such as fire, theft, vandalism, and natural disasters.

Remember to click Color schemes for home decor to understand more comprehensive aspects of the Color schemes for home decor topic.

Having home insurance is crucial for homeowners as it offers peace of mind knowing that they are financially protected in case of unforeseen events. It helps cover the cost of repairs or replacements, ensuring that homeowners do not have to bear the entire financial burden on their own.

Examples of Situations Where Home Insurance Can Be Beneficial, What does home insurance cover?

- Fire Damage: In the unfortunate event of a fire damaging your home, home insurance can help cover the cost of repairs or rebuilding.

- Theft: If your home is broken into and valuable items are stolen, home insurance can help replace those items or reimburse you for the loss.

- Natural Disasters: In areas prone to natural disasters such as hurricanes or earthquakes, home insurance can provide coverage for damages caused by these events.

- Liability Protection: Home insurance also offers liability protection in case someone is injured on your property, covering medical expenses and legal fees.

Dwelling Coverage

When it comes to home insurance, dwelling coverage is a crucial component that protects the physical structure of your home in case of damage or destruction. This coverage typically includes the house itself, as well as any attached structures like a garage or porch.

What Dwelling Coverage Includes

Dwelling coverage includes protection for the actual structure of your home, including walls, roofs, floors, ceilings, and foundation. It also covers attached structures like a garage or deck. In case of damage from covered perils like fire, wind, hail, or vandalism, dwelling coverage will help repair or rebuild your home.

How Dwelling Coverage Protects the Structure

Dwelling coverage provides financial protection by covering the costs of repairing or rebuilding your home in case of damage. This ensures that you don’t have to bear the entire financial burden of restoring your home to its pre-damaged condition.

Factors Impacting Amount of Dwelling Coverage Needed

Several factors can impact the amount of dwelling coverage you need, including the size and construction of your home, the local construction costs, and any additional features like custom upgrades or high-end finishes. It’s important to accurately assess the value of your home to ensure you have adequate coverage in case of a total loss.

Personal Property Coverage

Personal property coverage in home insurance refers to the protection provided for your belongings inside your home. This type of coverage helps reimburse you for the loss or damage of personal items due to covered perils like theft, fire, or vandalism.

Examples of Items Covered

- Furniture

- Electronics

- Clothing

- Jewelry

- Appliances

It’s important to review your policy to understand the specific items covered and any limits that may apply.

Tips for Documenting Personal Property

Documenting your personal property can help streamline the claims process and ensure you receive proper compensation. Here are some tips:

- Create a home inventory: Take photos or videos of your belongings and keep a detailed list of items, including purchase dates and values.

- Store important documents safely: Keep receipts, appraisals, and other documentation in a secure place or digitally.

- Update your inventory regularly: Make sure to add new items and remove old ones from your documentation as needed.

Liability Coverage

Home insurance liability coverage is designed to protect you financially if someone is injured on your property or if you accidentally damage someone else’s property. This coverage can help cover medical expenses, legal fees, and damages if you are found liable for the incident.

Scenarios where liability coverage would come into play

- If a guest slips and falls on your property, sustaining injuries that require medical attention.

- If your dog bites someone while they are visiting your home.

- If you accidentally damage a neighbor’s property, like breaking a window with a stray ball.

The importance of adequate liability coverage

Having adequate liability coverage is crucial to protect your assets and savings in the event of a lawsuit. Without enough coverage, you could be personally responsible for paying the medical bills, legal fees, and damages, which could potentially lead to financial ruin. It’s important to review your liability coverage limits regularly to ensure you have enough protection.

Additional Living Expenses Coverage

When your home becomes uninhabitable due to a covered loss, additional living expenses coverage can provide financial assistance for temporary living arrangements.

What Does Additional Living Expenses Coverage Offer?

- Temporary housing costs such as hotel expenses.

- Additional meal expenses above what you would normally spend.

- Costs related to transportation to and from your temporary residence.

- Storage fees for belongings while your home is being repaired.

Situations Where Additional Living Expenses Coverage Might Be Necessary

- Fire damage that renders your home unlivable.

- Severe storm damage that requires extensive repairs.

- A burst pipe that causes flooding and makes your home unsafe to inhabit.

Tips to Make the Most of Additional Living Expenses Coverage

- Keep all receipts and documentation of expenses incurred during your temporary living situation.

- Choose cost-effective temporary housing options to maximize the coverage amount.

- Communicate with your insurance company regularly to ensure you are following the necessary procedures to make claims.

In conclusion, home insurance serves as a vital shield against unforeseen events, providing peace of mind and financial protection. By understanding the different facets of home insurance coverage, homeowners can make informed decisions to safeguard their most valuable asset – their home.