Compare home insurance takes center stage with a detailed look at the types of policies, factors affecting rates, coverage options, discounts, and savings. Dive into this comprehensive guide to ensure you make the right choice for your home insurance needs.

Types of Home Insurance: Compare Home Insurance

:max_bytes(150000):strip_icc()/homeowners-insurance-guide_final-88e7d3469dcc4920977498f08564b234.png?w=700)

Home insurance policies come in various types to cater to different needs and preferences of homeowners. The most common types include basic, broad, and special form policies, each offering different levels of coverage and protection.

Basic Home Insurance

Basic home insurance policies typically provide coverage for specific named perils, such as fire, theft, vandalism, and certain natural disasters. These policies are more limited in scope compared to other types and may not cover all potential risks.

Broad Home Insurance

Broad home insurance policies offer more extensive coverage than basic policies by including additional perils beyond the named ones in the policy. This type of policy provides a broader level of protection for homeowners against a wider range of risks.

Special Form Home Insurance

Special form home insurance policies, also known as open peril policies, cover all risks except for those specifically excluded in the policy. This type of policy offers the most comprehensive coverage, protecting homeowners against a vast array of potential perils.

HO-3 vs. HO-5 Policies

When comparing HO-3 and HO-5 policies, it’s essential to understand the differences in coverage and premiums. HO-3 policies are the most common type of homeowners insurance, offering coverage for the structure of the home and personal belongings against named perils. On the other hand, HO-5 policies provide broader coverage for both the structure and personal belongings, typically including coverage for all risks except those explicitly excluded.

Ultimately, the choice between HO-3 and HO-5 policies depends on the level of coverage and protection that homeowners desire, as well as their budget for insurance premiums. It’s crucial to carefully evaluate the coverage options and premiums of each policy to determine the best fit for individual needs and circumstances.

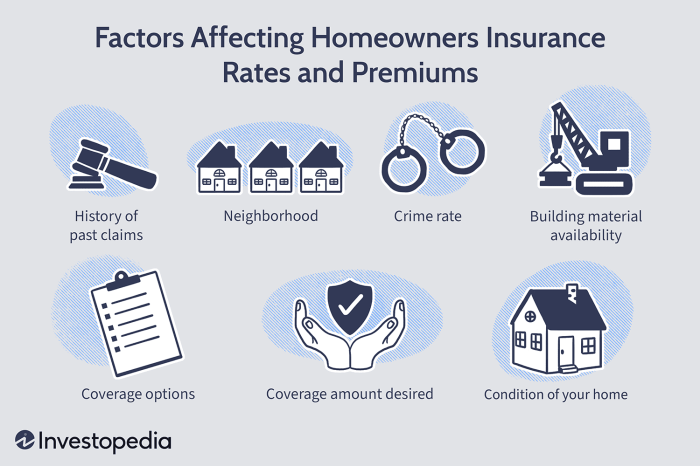

Factors Affecting Home Insurance Rates

When it comes to determining home insurance rates, several factors come into play. Location, age and condition of the home, and deductible amounts are all key influencers.

Location Influence on Home Insurance Premiums

The location of a home plays a significant role in determining insurance premiums. Homes located in areas prone to natural disasters such as hurricanes, earthquakes, or floods are at higher risk, leading to increased insurance costs. Additionally, crime rates in the neighborhood can impact insurance rates, with higher crime areas leading to higher premiums.

Age and Condition Impact on Insurance Rates

The age and condition of a home are crucial factors in determining insurance rates. Older homes may have outdated wiring, plumbing, or roofing, increasing the risk of damage and potential insurance claims. Similarly, poorly maintained homes are more susceptible to issues like leaks or structural damage, impacting insurance costs.

Deductible Amounts and Cost of Home Insurance

The deductible amount chosen by a homeowner directly affects the cost of home insurance. A higher deductible typically results in lower premiums, as the homeowner agrees to pay more out of pocket before the insurance coverage kicks in. On the other hand, a lower deductible means higher premiums but less financial responsibility in the event of a claim.

Coverage Options

When it comes to home insurance, there are several coverage options to consider in order to protect your property and belongings adequately. Understanding the differences between various coverage types can help you make informed decisions about your policy.

Actual Cash Value vs. Replacement Cost Coverage, Compare home insurance

Actual cash value coverage takes depreciation into account when determining the value of your property or belongings in the event of a claim. This means that the payout you receive would be based on the current value of the item, taking into consideration wear and tear. On the other hand, replacement cost coverage does not consider depreciation and would provide you with the funds needed to replace the item with a new one of similar kind and quality. While actual cash value coverage may be cheaper, replacement cost coverage ensures that you can replace your lost or damaged items without having to cover the depreciation cost out of pocket.

Importance of Liability Coverage

Liability coverage is a crucial component of a home insurance policy as it protects you financially in case someone is injured on your property or if you accidentally damage someone else’s property. This coverage can help cover legal fees, medical expenses, and other costs associated with a liability claim, providing you with peace of mind and financial protection.

Optional Coverage Add-Ons

In addition to standard coverage options, there are optional add-ons that you can include in your policy to enhance your protection. Optional coverage add-ons may include flood insurance, which is important if you live in a flood-prone area and standard policies do not cover flood damage. Another optional add-on is identity theft protection, which can help you recover from identity theft and cover expenses related to restoring your identity and credit.

Discounts and Savings

When it comes to home insurance, there are various discounts and savings opportunities that homeowners can take advantage of to reduce their premiums and save money in the long run. By understanding the common discounts offered by insurance companies and implementing strategies to lower insurance costs, homeowners can ensure they are getting the best possible coverage at an affordable price.

Common Discounts Offered by Insurance Companies

- Multi-Policy Discount: Many insurance companies offer a discount to policyholders who bundle their home and auto insurance together. This can result in significant savings on both policies.

- Security System Discount: Installing security systems such as burglar alarms, smoke detectors, and surveillance cameras can qualify homeowners for discounts on their insurance premiums.

- Claims-Free Discount: Homeowners who have not filed any insurance claims within a specific period may be eligible for a claims-free discount.

- New Home Discount: Insurance companies may offer discounts to homeowners with new or recently renovated homes, as these are seen as lower risk.

- Senior Citizen Discount: Some insurers provide discounts to senior citizens as a way to reward their loyalty and experience as homeowners.

Ways Homeowners Can Save on Insurance Premiums

- Compare Quotes: It’s essential to shop around and compare quotes from different insurance companies to find the best rates and coverage options.

- Increase Deductibles: By opting for a higher deductible, homeowners can lower their premiums. However, they should ensure they can afford the deductible in case of a claim.

- Maintain a Good Credit Score: A good credit score can help homeowners secure lower insurance rates, as it is often used by insurers to assess risk.

- Review Coverage Regularly: Periodically reviewing and updating coverage can help homeowners ensure they are not paying for unnecessary coverage or underinsured.

- Ask About Discounts: Homeowners should inquire with their insurance provider about available discounts and take advantage of any savings opportunities.

Compare Bundling Home and Auto Insurance for Potential Savings

- Bundling home and auto insurance with the same provider can result in a significant discount on both policies, making it a cost-effective option for homeowners.

- By consolidating policies, homeowners can simplify their insurance management and potentially save hundreds of dollars annually.

- It’s essential to compare quotes and coverage options when bundling policies to ensure that the overall cost and benefits meet the homeowner’s needs.

In conclusion, understanding the nuances of home insurance policies can help you protect your most valuable asset. Don’t overlook the importance of coverage options and potential savings. Make an informed decision to safeguard your home effectively.

Find out about how Affordable home decor can deliver the best answers for your issues.