Kicking off with Cheap home insurance rates, this opening paragraph is designed to captivate and engage the readers, setting the tone for what’s to come. When it comes to protecting your home, finding affordable insurance rates is crucial. Understanding the key factors that affect these rates and the types of coverage available can help homeowners make informed decisions. Let’s delve into the world of home insurance rates and explore tips on how to secure the best deal for your home.

Factors Affecting Home Insurance Rates

When it comes to determining home insurance rates, several key factors come into play. Understanding how location, home value, age of home, and claim history can impact insurance rates is essential for homeowners looking to secure the best coverage at the most affordable price.

Location

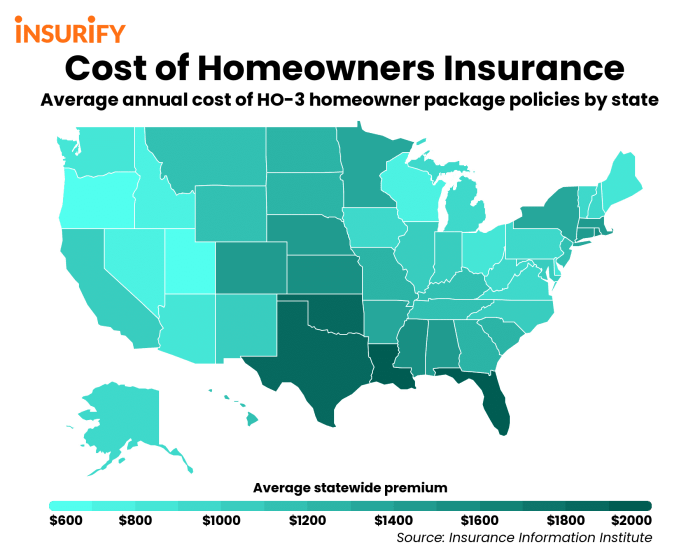

The location of your home plays a significant role in determining your insurance premiums. Homes located in areas prone to natural disasters such as hurricanes, earthquakes, or wildfires are considered high-risk and may result in higher insurance rates. Additionally, the proximity to fire stations and the crime rate in the neighborhood can also influence the cost of insurance.

Home Value, Cheap home insurance rates

The value of your home is another crucial factor that can impact insurance rates. More expensive homes typically require higher coverage limits, leading to increased premiums. The size of the home, construction materials, and additional features like swimming pools or guest houses can also affect insurance costs.

Age of Home

The age of your home is another consideration insurance companies take into account. Older homes may have outdated systems and structural issues that could increase the likelihood of claims. As a result, older homes may have higher insurance premiums compared to newer construction.

Claim History

Your claim history is a reflection of your past insurance claims. Homeowners who have filed multiple claims in the past are considered higher risk and may face higher insurance rates. Maintaining a claim-free history can help keep insurance premiums more affordable.

It’s important for homeowners to be aware of these factors and take steps to improve them where possible. For example, investing in home security systems, updating the home’s electrical and plumbing systems, and maintaining a claim-free record can help lower insurance rates.

These factors can vary significantly depending on the region or state where your home is located. For instance, homes in coastal areas may face higher rates due to the risk of hurricanes, while homes in areas prone to wildfires may have increased premiums to account for fire risk. By understanding how these factors influence insurance rates, homeowners can make informed decisions to protect their investment and save money on insurance coverage.

Types of Home Insurance Coverage

When it comes to home insurance, there are different types of coverage options available to homeowners. Understanding these options can help you choose the right policy for your needs and budget.

Basic Coverage

Basic coverage typically includes protection for your home’s structure, personal belongings, liability coverage, and additional living expenses in case your home becomes uninhabitable due to a covered loss. This type of coverage is essential for all homeowners as it provides a fundamental level of protection.

Comprehensive Coverage

Comprehensive coverage goes beyond the basics and offers additional protection for specific risks such as natural disasters, theft, or vandalism. While more expensive than basic coverage, comprehensive coverage provides broader protection and peace of mind for homeowners facing higher risks.

Additional Riders

In addition to basic and comprehensive coverage, homeowners can opt for additional riders to customize their policy further. Riders can cover specific items like jewelry, fine art, or collectibles that may not be fully protected under a standard policy. By adding riders, homeowners can ensure that their most valuable possessions are adequately covered.

Beneficial Situations for Each Coverage Type

– Basic Coverage: Ideal for homeowners on a budget looking for essential protection.

– Comprehensive Coverage: Suitable for homeowners living in high-risk areas prone to natural disasters or crime.

– Additional Riders: Beneficial for homeowners with valuable items that require additional coverage beyond standard policies.

Effect on Insurance Rates

Opting for different coverage types can directly impact your home insurance rates. Basic coverage typically comes at a lower cost compared to comprehensive coverage, which offers more extensive protection. Adding additional riders can increase your premiums but provide tailored coverage for specific items or risks.

Tips for Getting Cheap Home Insurance Rates

When it comes to getting affordable home insurance rates, there are several strategies homeowners can implement to lower their premiums and save money in the long run.

Bundling Home and Auto Insurance

- Consider bundling your home and auto insurance policies with the same provider to qualify for a multi-policy discount.

- Insurance companies often offer significant savings when you combine multiple policies, so be sure to inquire about bundling options.

Impact of Home Security Systems or Renovations

- Installing a home security system can reduce the risk of theft or damage, leading to potential discounts on your insurance premiums.

- Upgrading your home’s safety features or making renovations that improve its structural integrity can also result in lower insurance costs.

Negotiating Lower Rates with Insurance Providers

- Don’t be afraid to shop around and compare quotes from different insurance companies to find the best deal.

- Consider increasing your deductible or adjusting your coverage limits to lower your premium payments.

- Ask your insurance provider about available discounts or promotions that you may qualify for based on your circumstances.

Understanding Deductibles and Discounts

When it comes to home insurance, understanding deductibles and discounts is crucial for homeowners to save money and get the best coverage possible. Deductibles are the amount of money that homeowners are required to pay out of pocket before their insurance coverage kicks in. On the other hand, discounts are incentives offered by insurance companies to reduce the cost of premiums for policyholders who meet certain criteria.

Deductibles in Home Insurance

Deductibles play a significant role in determining the cost of home insurance premiums. Typically, the higher the deductible, the lower the premium. Homeowners can choose different deductible amounts based on their financial capability and risk tolerance. For example, opting for a higher deductible of $1,000 instead of $500 can lead to lower monthly premiums.

Common Discounts Offered by Insurance Companies

- Multi-Policy Discount: Insuring your home and car with the same insurance company can qualify you for a discount on both policies.

- Security System Discount: Installing security features like alarms, deadbolts, or smoke detectors can lead to discounts on your home insurance premiums.

- Claims-Free Discount: Maintaining a claims-free record over a certain period can make you eligible for discounts.

Impact of Adjusting Deductibles on Premiums

Increasing deductibles can lower insurance premiums, but it also means homeowners will have to pay more out of pocket in case of a claim. On the other hand, decreasing deductibles can result in higher premiums, but less financial burden at the time of a claim. It’s essential for homeowners to weigh the pros and cons and choose deductibles that align with their financial situation.

Reviewing and Adjusting Deductibles Regularly

Homeowners should regularly review their deductibles to ensure they are still appropriate for their needs. Life circumstances, financial situations, and property values can change over time, impacting the adequacy of deductibles. By staying proactive and adjusting deductibles as needed, homeowners can ensure they are getting the best value out of their home insurance coverage.

In conclusion, navigating the realm of home insurance rates doesn’t have to be daunting. By implementing the tips and strategies discussed, homeowners can potentially lower their insurance premiums while still maintaining adequate coverage for their valuable assets. Remember, staying informed and proactive is key to securing cheap home insurance rates that suit your needs and budget.

Expand your understanding about Rustic home decor with the sources we offer.